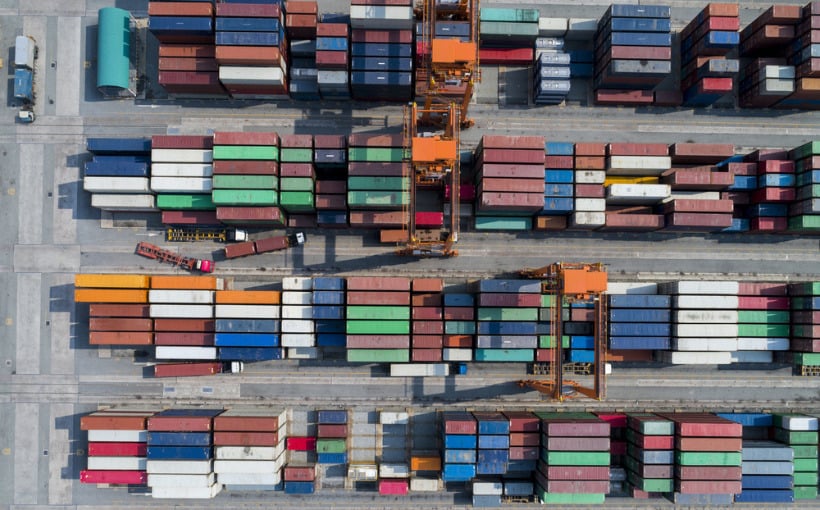

In the fourth quarter of 2023, Northern and Central New Jersey experienced a thriving industrial sector with record-breaking new leasing activity of 6.4 million square feet (msf), as reported by Cushman & Wakefield. Central New Jersey dominated with a significant increase of 20.9% in leasing activity compared to the previous year, accounting for 68.2% of total leasing for the year.

Despite lease renewals reaching an impressive 11.9 msf, there was a decrease in net absorption due to negative trends in Northern New Jersey, resulting in a vacancy rate increase of 300 basis points to reach at an overall rate of5 .8%.

The office market also saw noteworthy transactions during Q4 including Bankof America’s renewal and expansion totaling547 ,962 square feetinJersey Cityand Nokia Bell Labs’ commitmentof360 ,000squarefeetinNew Brunswick.However,thequarterexperiencednegative netabsorptionof1 .0msf,resultinginanegativeyear-to-datetotalof3 .0msf,andpushingvacancyratesto21 .6%.Average rental rates remained steady at $31.03 per square foot.

This quarter has seen sustained demand for Class A industrial properties across NJ despite challenges faced by other sectors.The post highlights this trend without mentioning specific organizations or locations.