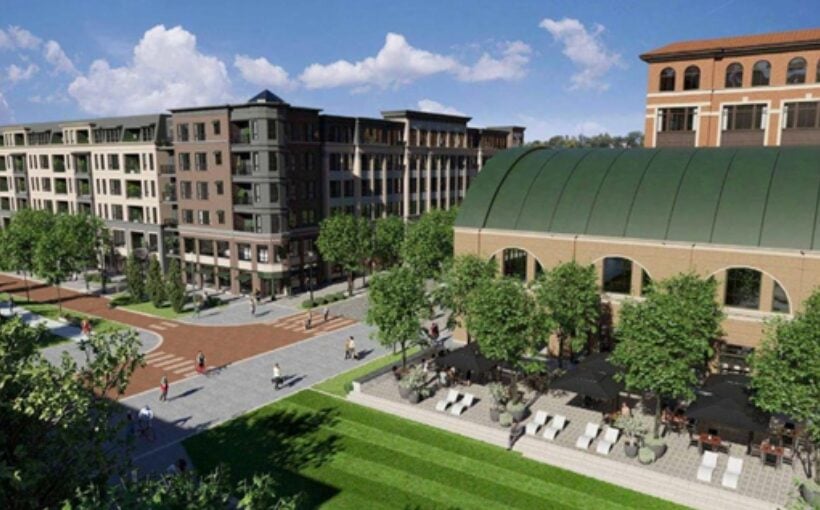

Pearlmark, a real estate investment firm, has recently completed two mezzanine debt investments totaling $19.5 million for the development of Monon Square. This project consists of two phases and will feature 120 units and 247 units in Carmel, Indiana – located approximately 15 miles north of downtown Indianapolis. These loans were originated by Pearlmark’s mezzanine debt platform.

The first investment was a $5 million mezzanine loan for the 120-unit development which marked the final investment in Pearlmark Mezzanine Realty Partners V, L.P. The senior loan was provided by Indiana Members Credit Union.

For the second phase consisting of 247 units, Pearlmark invested $14.5 million through their latest fund – Pearlmark Mezzanine Realty Partners VI, L.P., with Western-Southern Life Assurance Company providing the senior loan.

J.C Hart Company is developing this project in partnership with Stirsman Property Group while CBRE’s Jon Faulkenberg served as broker for this transaction. Mark Witt from Pearlmark arranged these deals on behalf of their company.