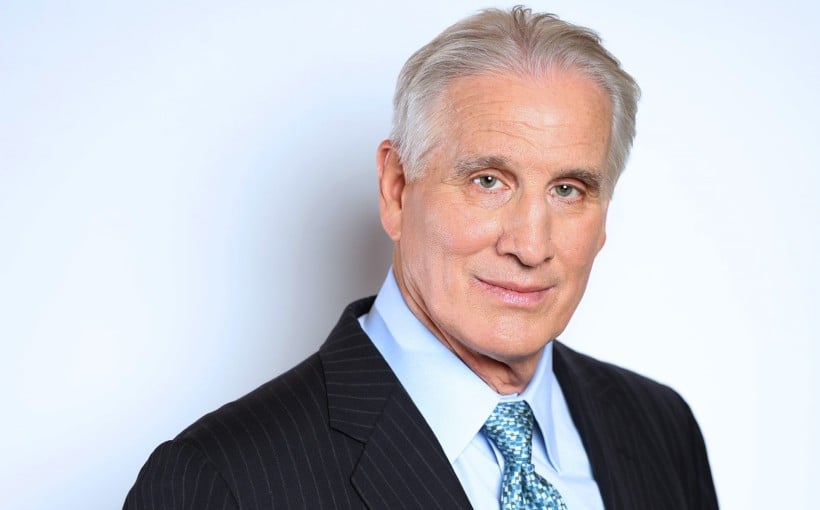

Quarterly, Walker Webcasts presents the “Most Insightful Hour in Commercial Real Estate” featuring renowned economist Peter Linneman and hosted by Walker & Dunlop’s Chairman and CEO, Willy Walker. The first webcast of 2024 was held on January 10th, marking their 16th session together. During this event, Linneman and Walker discussed various topics including debt (consumer, household and federal), the Federal Reserve, inflation and housing issues.

Linneman emphasized that while inflation has been a factor in recent economic volatility, the Federal Reserve has been out of touch with its interest rate policies due to their focus on year-over-year Personal Consumption Expenditures rather than annualized monthly figures which show a lower inflation rate of around 1-2%. He also noted that as the economy tries to return to “trend,” there is pent-up demand but about 20% is being hindered by interest rate increases.

The shortage of single-family homes was another topic addressed during the webcast. According to Linneman,the current shortage can be traced back to overbuilding starting in 2002 followed by market collapse during Great Financial Crisis leading construction halt resulting into shortfall mainly due NIMBYism.However,this shortfall creates opportunities for multifamily sector as people will have longer renting periods before saving enough for down payments thus increasing rental demand significantly.

Another important discussion revolved around whether it is an opportune time for real estate investment.Latest editionoftheLinnemann Letter suggests investingduring capital market volatility can leadto significant returns after ten years.However,Linemen pointed outthat many investors are making Type-2 Investing Errorsby not taking advantageof these opportunitiesdue fearand stayingon sidelines instead.

Walker shared statistics indicating where construction dollars were headed -15% towards office space ,7% towards retail ,4 % towards hospitality whereas24 % went towardsmultifamily projectswhile a whopping 48% was dedicated to industrial builds. Linneman noted that the rise of online shopping is driving demand for industrial space as every time something is bought online, more warehouse space is needed.

The conversation also touched upon the outlook for construction in other real estate sectors such as office and retail. Linneman found it interesting that despite the trend towards newer and better office spaces, there are still investments being made in older buildings with hopes of making them obsolete.

To conclude,the webcast ended with Walker asking Linnemann to make some predictions which included five cuts on EFFR by Federal Reserve ,10-year Treasury at 3½ %to4½%,stock market up by over7%and oil prices between $68-$70 per barrel.

For those who missed this insightful session,it can be viewed through Walker Webcast channels on YouTube, Spotify and Apple.